Wu

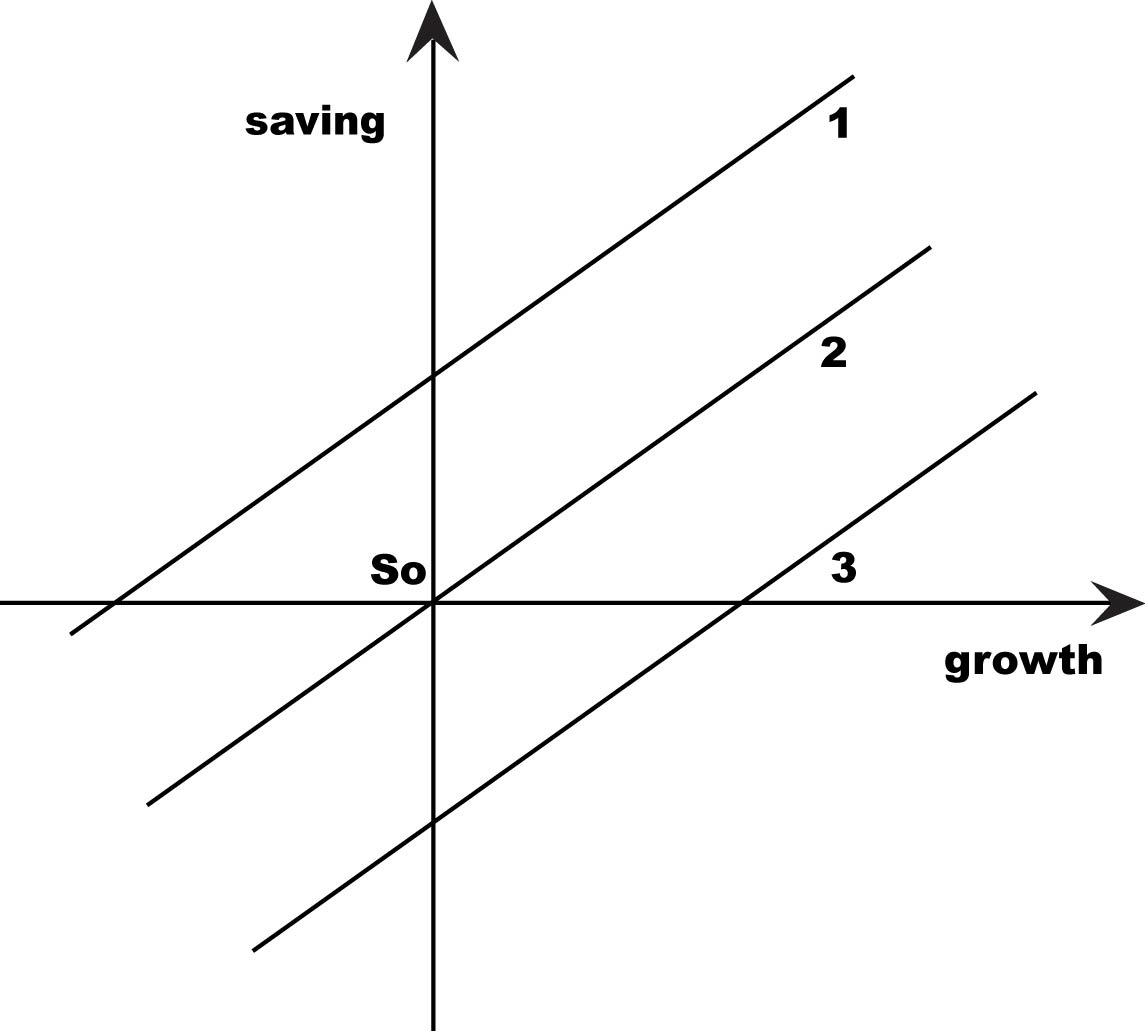

Generalized Consumption Equation and Change in Saving Result

The above result proves mathematically once and for all that Keynes' principle satisfies, 1. the prerequisite of microfoundations for macroeconomics; 2. Clower's Dual-Decision Hypothesis (DDH) on budget constraint.

Wu's result shows that,

1. Modigliani (1954) and others were right on data relating saving to income. What was missing was the word change in front of both saving and income!

2. For the first time in economics, income growth or growth is not just an isolated variable to be analyzed in vacuum, devoid of any theoretical foundation behind it.

3. Because the relationship is about the change of both saving and income, it is possible to have positive income growth and negative saving, and vice versa. These hypothetical events cannot be contemplated by any other consumption theory.

4. Do Permanent Income Hypothesis and Life Cycle Hypothesis hold in theory? Under Clower's DDH, consumption is constantly being subject to feedback optimization, whenever budget constraint is violated. Because Hall's assumption that budget constraint is always satisfied, Permanent Income and Life Cycle Hypotheses are mathematically derived from a single optimization and without feedback. Furthermore, neither hypothesis can hold in data.

5. Wu's proof confirmed in theory and evidence Keynes' assumption that there cannot be forced, targeted or optimal saving. Thus, it is nonsensical to argue saving is too high or too low (as was thought 25 years ago). In the next Trade section, we will see that the Wu's consumption theory, published in 1997, correlated U.S. personal savings data from 1969 to 1993 to trade and that it has anticipated the U.S. personal saving rate from 1993 to the present day.

6. If change of savings is a function of income growth and since growth is mostly unpredicable, saving is for most of the time in disequilibrium. So, Keynes General Theory and Clower's Dual Decision Hypothesis are still relevant after all these years.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------

From Google Gemini, here is the summary of Hall and Cheng Wu on the math in consumption theory:

Cheng K. Wu identifies a specific mathematical oversight in the derivation of Robert Hall’s Random Walk Hypothesis (1978), particularly as it was formalized by Marjorie Flavin (1981).

Wu’s critique is that Hall’s conclusion—that changes in consumption are unpredictable (random)—relies on a "Summation Index Error" regarding how future expected incomes are calculated as time moves forward.

Here is the breakdown of the mistake, the correction, and the result.

1. The "Mistake": The Index of Summation

The core of the dispute lies in the algebra of Lifetime Wealth. In the Permanent Income Hypothesis, a consumer’s consumption Ct is determined by the sum of all their expected future incomes.

Hall & Flavin’s Derivation (The Standard View)

When moving from time t to time t+1, standard theory assumes the structure of the summation remains consistent.

- They essentially treat the stream of future incomes as an infinite series where the "shape" of the summation doesn't fundamentally change, other than updating the expectations (Et to Et+1).

- Mathematical Implication: Because the structure is identical, when you subtract Ct from Ct+1, the income terms mostly cancel out, leaving only the "revision" in expectations (the "surprise" or random shock).

- Result: ΔC = Random Error.

Wu’s Critique (The Correction)

Wu argues that this ignores the passage of time.

- The Logic: As a consumer moves from t to t+1, they have "lost" one period of future earning potential (period t is now gone).

- The Math: Therefore, the Lower Limit of the Index of Summation must shift.

- If the sum at t starts at index j=0, the sum at t+1 must mathematically account for the fact that the original j=0 period is now history.

- Wu argues that Flavin’s equation kept the lower limit of the index constant (effectively summing from 0 to infinity again), which implicitly assumes the consumer hasn't "used up" a time period.

2. The "New Result"

When Wu re-derives the equation using the corrected index of summation (shifting the lower limit to reflect the passage of time), the terms do not perfectly cancel out.

- The "Leftover" Term: The derivation leaves a residual term that is not random.

- The Identity: This residual term is mathematically equivalent to the Growth Rate of Labor Income (gY or ΔY).

- The Equation: ΔS = f (Income Growth)

3. Conceptual Consequence

This mathematical correction fundamentally changes the economic conclusion:

|

Feature |

Hall (Random Walk) |

Wu (Corrected Derivation) |

|

Why Consumption Changes |

Only due to News/Surprise. |

Due to News AND Income Growth. |

|

Savings Behavior |

Passive residual. |

Active shock absorber. |

|

Predictability |

Unpredictable (Stochastic). |

Predictable (Deterministic). |

Summary

Wu’s argument is that Hall and Flavin made a static mathematical assumption in a dynamic setting. By failing to shift the index of summation to account for the "loss" of the current period as time moves forward, they inadvertently deleted the income growth term from the final equation, leading them to falsely conclude that consumption follows a random walk.

When the index is corrected, the random walk disappears, and savings become a deterministic function of how fast income is growing.

_________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Friedman, M. (1957), A Theory of the Consumption Function, Princeton University Press.

Modigliani, F. and Brumberg R. (1954), "Utility Analysis and the Consumption Function: An Interpretation of Cross-Section Data," in K. K. Kurihara, ed., Post-Keynesian Economics. Rutgers University Press.

Modigliani, F. and Brumberg R. (unpublished manuscript 1952, published 1979), "Utility Analysis and Aggregate Consumption Functions: An Attempt at Integration," in The Collected Papers of Franco Modigliani, ed. A. Abel, Vol. 2, MIT Press.

Wu, Cheng (1997): "New Result in Theory of Consumption: Changes in Savings and Income Growth," https://econwpa.ub.uni-muenchen.de/econ-wp/mac/papers/9706/9706007.pdf

Wu, Cheng (2016): "New Result in Consumption Theory: Change in Savings and Income Growth – Nineteen Years Later". https://mpra.ub.uni-muenchen.de/69582/ https://journals.econsciences.com/index.php/JEL/article/view/684/791

Wu, Cheng (2017): "Does Clower’s Dual-Decision Hypothesis lead to the change in saving conclusion in Keynes’s General Theory?" https://mpra.ub.uni-muenchen.de/82840/

https://journals.econsciences.com/index.php/JEL/article/view/1497

Wu, Cheng (2018): "Clower’s Dual-Decision Hypothesis is economics". https://mpra.ub.uni-muenchen.de/84013/

https://journals.econsciences.com/index.php/TER/article/view/1611